What are the changes?

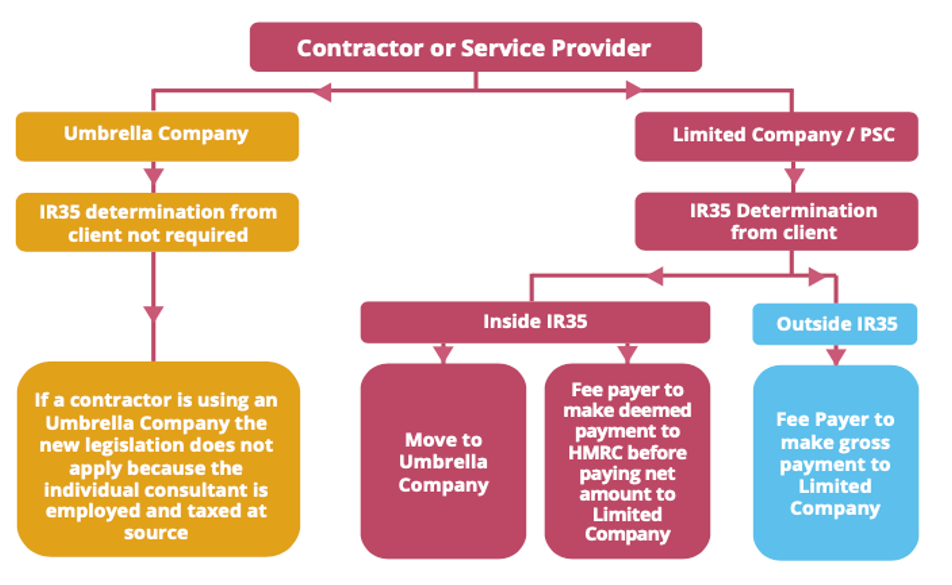

The biggest update to come from the new legislation is the change in who is responsible for determining a worker's IR35 status. Until now it has always been the PSC or Limited Company who decided whether the assignment a worker was committed to completing was inside IR35 or if the rules did not apply, otherwise known as outside IR35. However, the new legislation dictates that this responsibility will now be in the hands of the end client who will make the decision on behalf of the worker.

If the end client decides that the rules apply to the assignment (inside IR35) then the fee payer (whoever is closest to the Limited Company in the contractual chain) will be required to make a deemed payment to HMRC. This will include PAYE Tax and National Insurance contributions, before then paying the net amount to the Limited Company.

If the end client decides that the rules do not apply (outside IR35), then the fee payer would then make a standard gross payment to the Limited Company without any deductions.

Frequently asked questions

IR35 is a legislative instrument used by HMRC to identify disguised employment status and counter tax avoidance by identifying and targeting contingent workers who operate like an employee.

From the 6th April 2021, when a contingent worker is considered to be inside IR35:

- The ‘fee payer’ (agency) must pay employer’s National Insurance on top of the agreed rate

- The fee payer must deduct income tax and National Insurance from the worker’s pay rate via PAYE

- The end user is now responsible for assessing the IR35 status of their contingent workforce and providing a status determination to the worker and known entities within the supply chain

- The end user and agency can be liable for unpaid tax, penalties and interest if they haven’t demonstrated “reasonable care” during the assessment

Prior to the legislation coming into effect, the contingent worker would determine their own IR35 status. However, from April 2021, this responsibility will shift to the end user. If you engage contingent workers via a fee payer (agency), it’ll be the fee payer who’ll be liable for an incorrect status determination. That being said, the end user is still responsible for assessing and determining the status of their contingent workforce.

Several elements need to be considered, the three key elements being Control, Personal Service (Substitution) and Mutuality of Obligation. Most clients are using the government CEST Tool to make a determination which can be found here.

We have also partnered with Qdos to ensure ‘reasonable care’ an independent IR35 consultancy.

The key thing to remember as a client is that you need to legally take ‘Reasonable Care’ in making the determinations otherwise there is a risk that liability can be passed back to you as the client.

Reasonable care was added to the legislation before the reform to the Public Sector rules in 2017. It was to prevent clients making blanket determinations and to mitigate the risk of incorrect determinations being provided.

Reasonable care hasn’t been properly defined however it is sensible that clients do the following:

- Ensure all of your hiring managers are trained on the new rules and how to apply them

- Have a well-documented determination process

- Make a determination on each individual assignment/contractor rather than blanket determinations

- Setup an IR35 working group internally who can assist with making determinations

- Ensure that the relevant contractor is consulted when making determinations so that you can see the full picture.

If the end client determines a contingent worker’s IR35 status incorrectly, it will be extremely costly to the organisation.

If a worker is wrongly deemed as outside IR35, HMRC may launch an investigation.This could lead to back taxes, penalties and interest. If a worker is wrongly deemed as inside IR35, as demonstrated with the public sector reforms, workers are likely to increase their rates or abandon projects when they don’t feel the assessment was fair.The end user must set up a process that allows contingent workers to challenge decisions.

With both decisions, the end user needs to demonstrate “reasonable care” when making status determinations. If the end client has shown ‘reasonable care’ they could find themselves liable to penalties from HMRC.

HMRC has developed a basic online tool, CEST, to help the end user assess whether an individual is inside or outside IR35. While it can deliver a result within minutes, it has been heavily criticised as it’s provided incorrect IR35 decisions in existing IR35 court cases.

To guarantee a compliant process, we’ve partnered with several legal experts to undertake all IR35 assessments. Not only will this ensure all contingent workers have the correct IR35 status, it also leaves an audit trail of the outcome and supporting documents. They’ll also be on hand to provide legal advice and best practice moving forwards.

If the contractor/worker disagrees with the determination they are able to appeal through a new client-led disagreement process and the end client will have 45 days to reply. If the end client stands by their initial determination then they will have to provide the reasoning behind it. If they agree it was incorrect, they can provide a new Status Determination Statement.

A blanket assessment is where the end user predetermines an IR35 status decision without conducting

an individual assessment and instead basing the decision solely on job description or role. Not only is this failure to take reasonable care, it also assumes the set of circumstances identified are applicable to anyone in that role, leading to wrong, unlawful IR35 determinations. Failure to demonstrate reasonable care could result in a huge tax burden for the end user.

To try and counterbalance risk, many organisations are applying blanket bans on all contracts. Organisations that adopt this approach will only engage workers on a “on-payroll” basis. While mitigating potential risk, organisations who adopt a blanket ban should be prepared for rising costs and recruitment challenges as workers increase their rates to offset the rise in tax or gravitate towards organisations that are prepared to engage workers outside IR35.

Every worker must be treated with respect regardless of whether they are a contingent worker or permanent employee. However, it is important to remember that contingent workers aren’t employees, and therefore shouldn’t be seen to be or treated as ‘part’ of the organisation..

Client Solutions IR35

Removing the risk from IR35.

If you are looking for further information on IR35 reform (Off – Payroll working legislation), what your options are and how to navigate your way to building a compliant, solution to engage a temporary workforce then please download our guide here.

If you would like to talk to one of our experts, please get in touch using the form. If you'd prefer to talk to us right away, call us on 01785 339 000.