- Site Navigation

- About Us

- Meet the Team

- Join us

- Job search

- News

- Contact us

- Our Expertise

- Engineering Recruitment

- USA recruitment

- Account

- Login

- Register

- Upload CV

- Submit A Vacancy

IR35 Contractor hub

What is IR35?

IR35 is the tax legislation that's designed to combat tax avoidance.

Introduced by Her Majesty's Revenue and Customs (HMRC), the IR35 legislation is targeting workers who are supplying their services to clients via an intermediary, a Limited Company (Ltd) or a Personal Service Company (PSC), who would be classified as an employee if the intermediary wasn't being used. These are being referred to by HMRC as 'disguised workers'.

Although it's coming into play for the Private Sector in April 2021, IR35 has been around for a number of years. Initially introduced in 2000, the UK Government made changes to the legislation in 2017, specifically for the public sector.

Currently self-employed individuals operating through a PSC in the Private Sector will receive a gross payment to their company and can split their income between a salary and dividends. This usually creates a tax benefit to the contractor which results in a higher take home.

HMRC intends to use IR35 reform to clarify instances where a contractor is using a PSC to provide services to a company but is operating as an employee. These 'disguised employees' are expected to pay a similar amount of Income Tax and National Insurance contributions as someone who is employed.

For more information directly from HMRC please follow this link.

What are the changes?

The biggest update to come from the new legislation is the change in who is responsible for determining a worker's IR35 status.

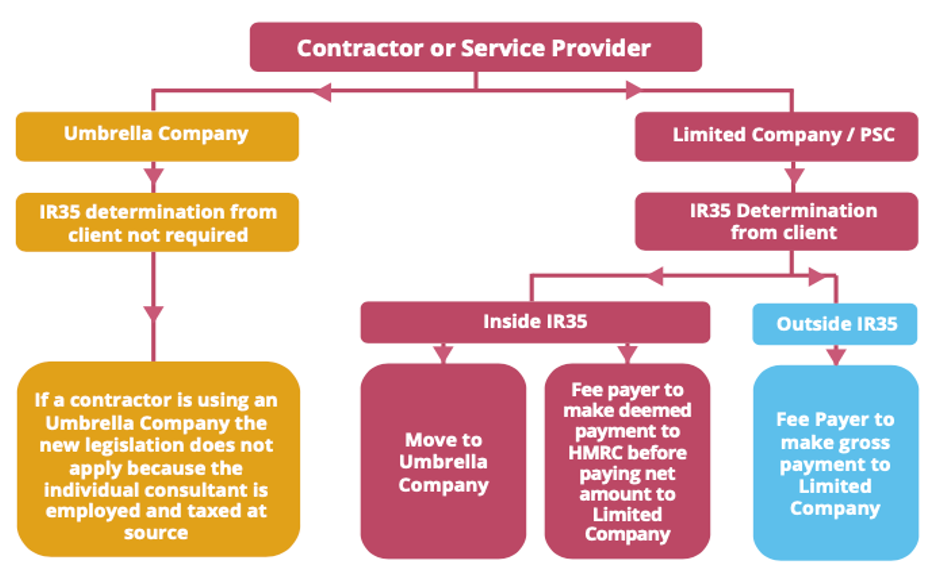

Until now, it has always been the PSC or Limited company who decided whether the assignment a worker was committed to completing was Inside IR35 or if the rules did not apply, otherwise known as Outside IR35. However, the new legislation dictates that this responsibility will now be in the hands of the end client who will make the decision on behalf of the worker.

If the end client decides that the rules apply to the assignment (inside IR35) then the Fee payer (whoever is closest to the Limited Company in the contractual chain) will be required to make a deemed payment to HMRC. This will include PAYE Tax and National Insurance contributions, before then paying the net amount to the Limited Company.

If the end client decided that the rules do not apply (outside IR35), then the Fee Payer would then make a standard gross payment to the Limited Company without any deductions.

Need IR35 support?

With 50 years of recruitment experience, we're the right choice for IR35 compliance. If you would like to talk to one of our experts, please get in touch using the form. If you'd prefer to talk to us right away, call us on 01785 339 000.

Prefer to talk directly?

Call us → (+44)1785 339 000

- Site Links

- Home

- About us

- Job Search

- Insights

- Join Us

- Meet the Team

- Contact

- Privacy Policy

- Clients

- Submit a Vacancy

- Candidates

- Login

- Register

- CV Upload

- Job Alerts